CAPITALlessISM

AND ABOUT HOW TO FREE OURSELVES FROM IT…..

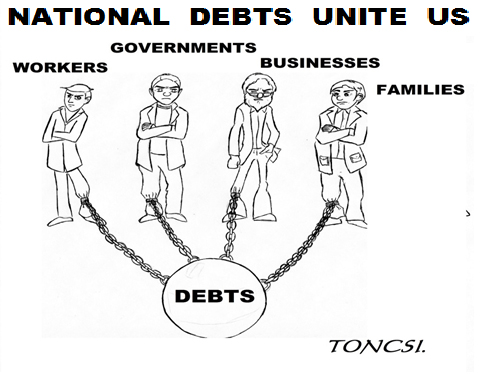

In our last article we discussed some legal grounds to justify the recalculations and the decrease of national debts. These four methods are just another opinion of the author of a new controversial economic phylosopy, CAPITAL-less-ISM. to be published soon. http://www.capital-less-ism.com/ In this dynamic model, the economy is viewed as a gigantic circulating financial information (capital) system much the same way as the blood is circulating in the human body. The author demonstrates that exactly the same way as in the human body a critical amount of blood must circulate to sustain life, also in a nation’s economy a critical amount of capital must circulate to sustain its production-consumption exchange survival. Life equates econmy. Below this blood-capital level death or economic ‘’death’’ occurs.

In order to introduce you, somewhat simplisticly I admit, our concept about the method of how to pay back national debts, … let me illustrate it with a little story. Once a very poor man went into a sausage-grill store, even though he did not have money to buy the sizzling appetizing sausage. So his mouth watering, he began to eat his maigre piece of bread … with real gusto with the appetizing succulent smell lingering around the store. To his surprise the owner watching him for a while ordered him to pay two dollars for the enjoyment of the smell. The following heated argument attracted the nearby policeman who was doing his rounds in the neighborhood. He demanded explanations from both parties. After listening carefully to both of them, in order to settle the dispute the lawman sternly demanded a two dollar coin from the poor man. With sad discouragement, he obliged while the greedy store owner watched grinning with satisfaction. However, the policemen taking the coin, has rolled it repeatedly several times on the counter…. And finally told the owner ‘’HERE THIS MAN HAS PAID FULLY FOR THE SMELL OF THE SAUSAGE WITH THE TINKERING SOUND OF HIS ROLLING TWO DOLLAR COIN…’’ and gave it back to the poor man. Amazing wisdom!!! …. Don’t you think?…. so maybe the same wisdom could be applied to paying back national debts. Why…?

THE NATIONAL DEBTS CONSIST MOSTLY OF VIRTUAL NON-EXISTENT ‘’MONEYS’’ LENT TO GOVERNMENTS AS LOANS OF REAL MONEY. ….. SO WHAT’S WRONG PAYING THEM BACK ALSO WITH NON EXISTANT, VIRTUAL MONEY, ARTIFICIALLY CREATED AS A NATIONAL CAPITAL RESERVE POOL, CREATED BY A NATIONAL FRACTIONAL RESERVE BANKING PROCESS. FAIR IS FAIR….

The evidence showed that there wasn’t enough real capital in bank reserves to lend. The evidence showed that the nature of national debts in reality consists of only about 1%-to-5% of real borrowed money and the rest of the borrowed amount wasn’t real money. The other 98% of the debt was ficticious non-existant capital loaned as real capital, basically as an unsecured loan, as a monopoly game type money. For which the repayment in real money was requested and guaranteed by governments from the taxpayer’s money. However questionable this shrewd practice, this brilliant CAPITAL-less banking system nevertheless proved itself that it works. Fine!….But the moral implication concerning the obligation for repayment of the interest on the global amount of the national debt becomes questionnable. Our conclusion is that while paying interest on the real money borrowed and secured by real monetary reserves is an obligation, the interest repayment obligation of the phantom capital portion is questionable. Much in the same line of thought is the re-calculation of the real size of the national debt. If we soubtract the phantom portion from the global national debt we might end up saying that basically our national debt is only about 2% of the global amount claimed by banks. Let alone if we calculate the global interests paid already on the phantom portion we might end up owning hardly anything …. But I might be wrong.

In any case, as a consequence of this fundamental consideration, there are four angles to consider as a FAIR WAY OUT and decrease the size of these huge national debts. These four solutions are outlined in detail by the author in a soon to be published book and author of a new controversial economic phylosopy, CAPITAL-less-ISM. … where SUFFICIENT capital circulation in a NATION is as crucial as SUFFICIENT blood circulation in our BODY.

First option: as mentioned, by reexamining the nature and recalculating the size OF THE NATIONAL DEBT. The differentiation of REAL CAPITAL from PHANTOM CAPITAL in the global amount borrowed.

We could retroactively re-estimate the real capitals lent (as reserves in the banks at the time of lending) and re-estimate the amounts of real capital and of phantom capital. Also review all interests paid for the phantom capital portion. Simply set the books back.

Second option: paying your NATIONAL ‘’VISA’’ DEBT with your NATIONAL ‘’MASTER-CARD’’ CREDIT.

It is a bit bold! Every country should establish their own NATIONAL PUBLIC BANK and assure their own ‘’fractional reserve banking’’ rights as any other bank. Then, this new National Public Bank could simply create its own ‘’phantom’’ capital as credit and simply pay back the national debt with this new credit. Virtual loans paid by virtual money.

Third option: balancing out franchising licensing fees for using “national fractional reserve banking” with paying off national debts to private banks.

Once the National Public Bank established, the fractional reserve banking rights could be nationalized as a public property like the road system. (NOTE: not the banks themselves but only the ‘’fractional banking rights’’). Under the new public-private banking partnership program, these then could be ‘’franchised back to banks’’. So then the P.O.N.C. Bank would receive back the lion’s share of all virtual capitals created by the licensed private banks. So the P.O.N.C. Bank would receive back 50 to 75% of all virtual capitals created by private banking institutions. From this amount of virtual capital the P.O.N.C. Bank would easily negotiate a repayment plan of previous national debts.

Fourth option: a new I.M.F. could simply buy back all national debts at fair market prices.

When the real estate market busted in the U.S. repossessed houses were sold at a fraction of their original market value. When unpaid defaulted consumer debts plagued massively financial institutions, they were sold for 1% of their original value to credit institutions. The same could be applied for national debts. The commercial value of the national debt of Greece is next to nil, because the chances of repayment are nil. So by buying back these national debts would give these countries a new life… without obliging them to ggo through an international humiliation. It could be combined with a program of national debt buy back and combined by some personal debts buy-back program.

This policy would give the United Nations and the I.M.F. some humanitarian image of respectability. The I.M.F. could start a new foundation where offshore banks could contribute, including some billionaires, like Saudi king, Warren Buffet, BillGates and many other phylantrophes, and/or maybe even the bank of Vatican as a new Christian initiative could associate itself to save third world countries from humiliating bankrupcy. It would also prevent the radicalization tendency of the third world countries.

These measures could liberate huge amount of annual interest payments back to the reserves of the National Banking and to the national economy of many impoverished countries. This mutual pact in sharing “fractional reserve banking” rights would also bring in huge revenues to the government. This harmonious cooperation between the private and the public banks would instantaneously create an efficient financing network similar to the brain, heart and the blood vessels in the body.

Well maybe I am dreaming ….. thank you.

Recent Posts

-

#-6- What is austerity for the dummies like me?

Media…. And what are its chain reaction consequences…...

-

#-5- Why are austerity measures wrong and outdated?! …..a short lesson on AUSTERITY.

Media#-5- Why are austerity measures wrong and outdated?!...

-

#4 AUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE SOLUTION FOR RESSURECTING GREECE’ ECONOMY.

MediaAUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE...

-

#3 FOUR FACE SAVING SOLUTIONS FOR GREECE AND OTHER DESPERATE NATIONS TO RE-NEGOTIATE A DECREASE OF THE SIZE OF THEIR NATIONAL DEBTS.

MediaAND ABOUT HOW TO FREE OURSELVES FROM IT….. In our...

-

#2 Should Greece and other developing nations review the size of their national debts… on legal grounds?

MediaGreece, Spain, Argentina and many other nations are...

Recent Portfolio Items

Portfolio Categories

- No categories