CAPITALlessISM

Greece, Spain, Argentina and many other nations are hemorrhaging to a slow agonizing financial death …in trying to pay interest on their never repayable staggeringly huge national debt!… but what is national debt anyways?

Legally, Greece should not default … but should interest payment on the national debt be a priority over obligation to assure the survival on the people? ….Morally, maybe the I.M.F. should do a little soul-searching also. Maybe an elegant face saving solution could be worked out for both parties involved.

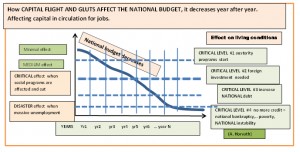

This is just another opinion of the author of a new controversial economic phylosopy, CAPITAL-less-ISM. soon to be published. http://www.capital-less-ism.com/ In this dynamic model, the economy is viewed as a gigantic circulating financial information (capital) system much the same way as the blood is circulating in the human body. As the blood circulation sustains functioning of cells… capital circulation sustains production/consumption. Sufficient amount of capital must circulate freely as the blood in the body, otherwise capital ‘’flight’’ out of the country will DEPRIVE enterprises, institutions and people suffocating the entire economy, causing economic death.

AND NOW THE NEW IMPROVED SUPER EFFICIENT CAPITAL-BLOOD TRANSFUSION AND BLOOD REPAYMENT METHOD

Interest payments of 40—50% of the gross national revenues, constitute such a capital flight, depriving and suffocating development programs and social programs.

Let’s examine what is the true nature and the origins of national debts? During World War 1 and later during World War 2, the staggering demand for capital to sustain the war effort compelled banks to lend warring governments ficticious non existent capital, because capital reserves were insufficient. So, using the old concept of ‘’fractional reserve banking’’, 20-30 times more capital was lent out as loans than what was really in the reserves. For you writing out cheques with non sufficient funds is a felony, for banks it is ‘’creative enterpreneurship’’. For you, creating counterfeit money is a felony but creating artificial money as loans is legal for banks. The repayment in real money is guaranteed by governments and the taxpayers. So, ‘’fractional reserve banking’’…or artificial currency creation is the most brilliant idea, It is a very lucrative business… as long as interests are being paid on this ‘’phantom’’ capital by governments. Today banks use this process, lend out 110 times every dollar that is in their reserve. So no wonder national debts have skyrocketed.

As long as the economy was rolling everybody seemed happy. But as the economic stagnation set in, as the crisis increased, and as unrestricted capital flights out of a nation bled the economy, the inevitable result is that the capital circulation in the economy had drastically weakened. All these depleted the national reserves in circulation below a critical level. Beyond this point, the symtoms of strangulations appeared in the economy, suffocating certain key sectors. This is when the frictions started. As long as the government spendings covered their political agenda and at the same time it did not interfere with the interest paments on the national debt, nobobody seemed alarmed. However, when the crisis caused 50% unemployment, and when elected politicians came under fire to boost social programs to assure survival of the people… there just doesn’t seem to be enough money left to pay interest on national debt….. as it is calculated presently.

But wait a minute … let’s review a bit our method of calculation! Maybe we do not own so much….. just maybe!!!!!

If we go back to base one when we first contracted our national debt for the war. Let’s say the governement got 100 billion dollars as a war-loan … in reality we got maybe only 5 billions in real money from the real reserves and the rest 95 billions were only phantom non-existant capital. So my questioning is this: is it fair to demand paying interest on the phantom capital lent to us!!?? I have no problem assuming my obligations of paying interest to pension funds …. Where real saved up money of hard working people are concerned… but I question why should I have to pay interest on non existant ficticious capital, that could not have been come to existence had the governments not guaranteed it to begin with my taxes. It was a brilliant monetary bluff like in a giant monetary poker game. Consequently, the entire recalculation of the national debt and the incurred interest calculation is based on this simple assumption that we should only pay interest on the portion of the loan which represent the real capital portion (from the banks’ reserves) and we should not have any obligation to pay interest on 95% of the portion that wasn’t real capital, but only a virtual capital creation by the ‘’fractional reserve banking’’ process.

Now before everybody starts throwing eggs at me for this propostrous idea, I say to people why not, I recognize that it was brilliant solution to an urgent situation of lack of capital. It bcame to be most genius idea that proved that a CAPITAL-less-BANKING is feasible, and that CAPITAL-less-ISM actually works. So the banks actually deserve some credit for this fantastic invention… they also deserve some royalty for their invention…. But definitely not full interest payment for money they did not have and did not lend either.

So what to do with the national debts…. Simple!!! recalculate them retroactively for the past 100 years. We will realize that by having paid interest fully for the real capital portion loaned out included also the interest on the phantom capital portion, we have paid way-way too much already. Let’s be fair we should include a generous royalty to compensate the banks for having invented this process that permits a CAPITAL-less Economy to function like magic. The results of these bold re-calculations would probably reveal that nations already paid off already a long-long time ago their original debt’s real capital portion. As for the phantom portion…. Oh well!!! Since there was no real money involved so then why should there be a repayment obligation ???

Off course these considerations are quite startingly flabbergasting. So we should look for elegant face saving solutions for all parties involved. Borrowing nations shouldn’t unilaterally decide to default on their debts. It would create economi chaos. Lending institutions should not coerse nations to austerity programs stnagling their survival… only to satisfy interest payments.

So in our next article of these series we are going to indicate four face saving solutions that would permit all parties involved to find solutions to their national debt problems.

Recent Posts

-

#-6- What is austerity for the dummies like me?

Media…. And what are its chain reaction consequences…...

-

#-5- Why are austerity measures wrong and outdated?! …..a short lesson on AUSTERITY.

Media#-5- Why are austerity measures wrong and outdated?!...

-

#4 AUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE SOLUTION FOR RESSURECTING GREECE’ ECONOMY.

MediaAUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE...

-

#3 FOUR FACE SAVING SOLUTIONS FOR GREECE AND OTHER DESPERATE NATIONS TO RE-NEGOTIATE A DECREASE OF THE SIZE OF THEIR NATIONAL DEBTS.

MediaAND ABOUT HOW TO FREE OURSELVES FROM IT….. In our...

-

#2 Should Greece and other developing nations review the size of their national debts… on legal grounds?

MediaGreece, Spain, Argentina and many other nations are...

Recent Portfolio Items

Portfolio Categories

- No categories