CAPITALlessISM

…. And what are its chain reaction consequences… short, medium and long term?

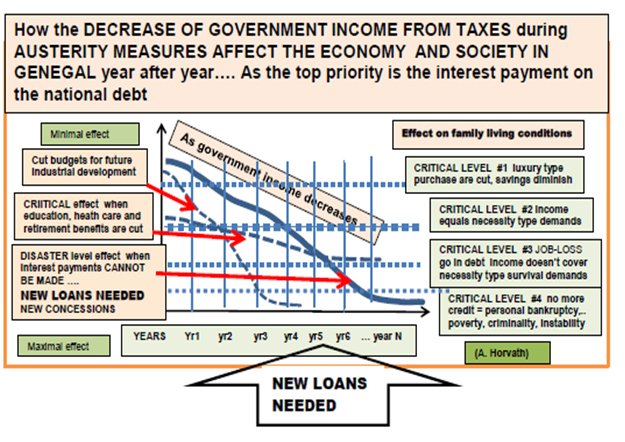

Austerity is a solution for the banks but a burder to rest of society. By definition austerity measures proposed by banks as a solution for the crisis are counterproductive on medium term. Essentially they emphasize cutting down on government spending and limiting indebtment by people. However this in return produces direct income losses for people and by the governments, consequently losses on the income-spending chain. As a downspiralling cycle, it is thus causing less income for people to spend, consequently less profit for enterprises. As the downspiralling spending cut goes on profit losses in businesses will result job losses. This causes direct revenue losses for goverments in the form af tax revenues from enterprises and individuals. As a chain raction, this in turn will result a social burden for the government. They must provide some form of social assistance to avoid violence. However banks as in Greece insist that social programs be cut also, (social assistance, health-care, education, pension funds and retirement age). Basically austerity measures are designed to save up enough money in the national budget to assure payment of the interest for the national debt. So banks want to protect their interest revenues above all other social and national development considerations.

While this is perfectly legal the question …is it morally legitimate?

The problems and the weaknesses with austerity measures.

Austerity measures do not make considerations for an analysis of the national spending. Not on capital flight out of the country.

When Greece got a loan, it covered its immediate interest payment needs ( banks were haapy) but since unemployment is in the 40-50% rate its social burden increased. Government revenues from inc taxes do not cover social expenses + interest payment + future developments. So back to square one …. Go back to the table and ask for more loans …. Only to be told to make more cuts. However it did not stipulate that capital flight should be cut, in order to preserve a cert amount of circulating capital in the nation… to create new jobs. Instead german companies are doing booming business selling Greece their products, decreasing Greek employment, greek nat-incom, taxes etc.

So what is the LOGICAL solution , plug the hole in the barrel befor filling it up otherwise you waste capital and increase frustrations. Then create job and enterprises … more income for people more profit for enterprises and more tax revenues for governements and a downspiral of the socio-economy of the country. At the end of the cycle governements go more and more in debt because income-tax revenues don’t cover their needs = social programs + future development + interest payments on the national debt + capital repayment of the national debt. And they must offer many collaterals and concessions on their natural resources to multinationals and also lifting regulations and restrictions .

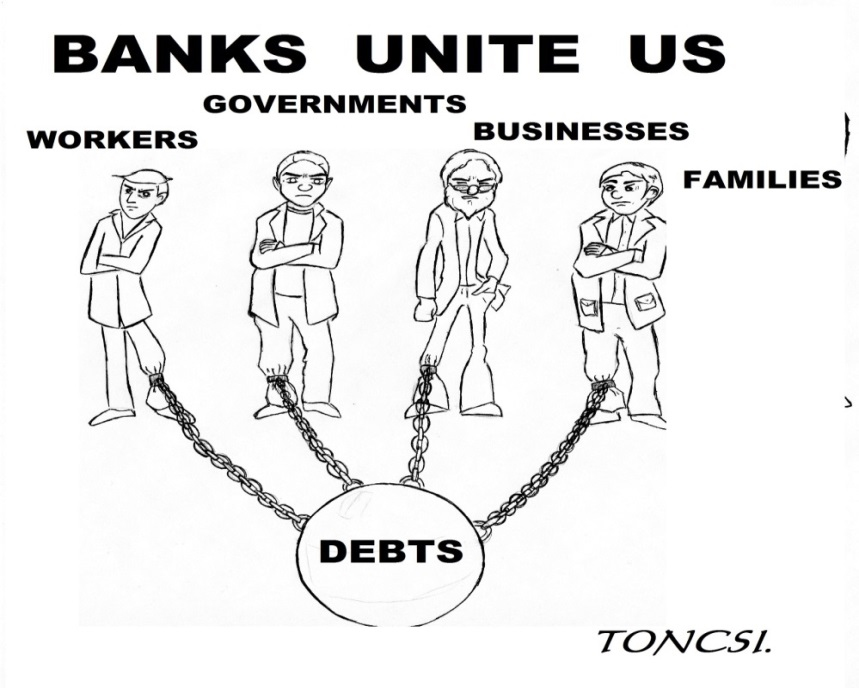

Workers go into debt when they lose their jobs, because of job cuts and cannot find employment and must offer as collateral their homes.

Families go into debt when they cannot cover their essential necessities for food, lodging, clothing, medical and education expenses.

Businesses go into debt when their profit margin shrinks because of diminishing revenues, because of generalized spending cuts, because of unrestricted cheap imports, because of unfair competitions from foreign firms.

The ultimate consequences of austerity measures : national and personal debts skyrocket

Recent Posts

-

#-6- What is austerity for the dummies like me?

Media…. And what are its chain reaction consequences…...

-

#-5- Why are austerity measures wrong and outdated?! …..a short lesson on AUSTERITY.

Media#-5- Why are austerity measures wrong and outdated?!...

-

#4 AUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE SOLUTION FOR RESSURECTING GREECE’ ECONOMY.

MediaAUSTERITY : THE GERMAN MIRACLE WORKER …. A TENTATIVE...

-

#3 FOUR FACE SAVING SOLUTIONS FOR GREECE AND OTHER DESPERATE NATIONS TO RE-NEGOTIATE A DECREASE OF THE SIZE OF THEIR NATIONAL DEBTS.

MediaAND ABOUT HOW TO FREE OURSELVES FROM IT….. In our...

-

#2 Should Greece and other developing nations review the size of their national debts… on legal grounds?

MediaGreece, Spain, Argentina and many other nations are...

Recent Portfolio Items

Portfolio Categories

- No categories